Wall Street Shaken as Trump’s Tariff Threats and China Crackdown Rattle Investors

The stock market took a hit on Tuesday as renewed tariff threats from former President Donald Trump and a potential crackdown on China spooked investors. The impact rippled across Wall Street, sending major indices tumbling and triggering fresh concerns about the economy’s growth prospects.

Market Meltdown: What’s Behind the Sell-Off?

Investors were caught off guard as Trump signaled that his trade overhaul isn’t over. His brief but impactful remark about implementing tariffs on Mexico and Canada next week sent shockwaves through financial markets, fueling fears of escalating trade tensions. Simultaneously, reports surfaced that his administration is pushing for stricter chip curbs on China, potentially tightening the screws on tech giants.

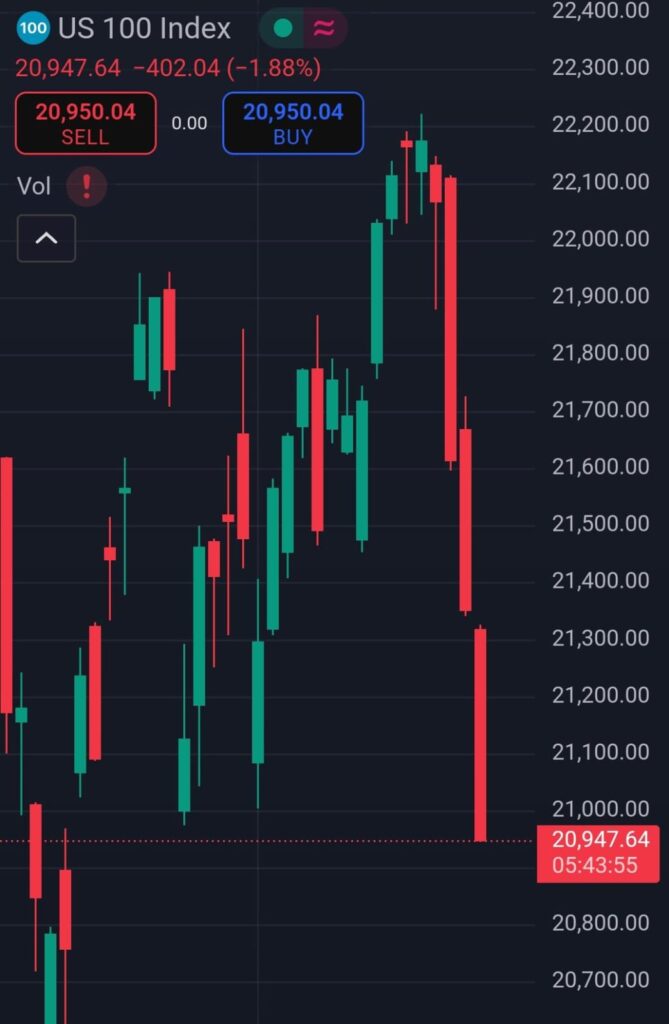

The tech-heavy Nasdaq Composite (^IXIC) bore the brunt of the sell-off, dropping 1.6% after a similar tech-led decline on Monday. The S&P 500 (^GSPC) followed with a 0.7% dip, while the Dow Jones Industrial Average (^DJI) managed to stay relatively stable, falling just 0.1%.

Consumer Confidence Crumbles Amid Inflation Jitters

Adding fuel to the fire, consumer confidence took a nosedive in February, marking its steepest monthly decline in over four years. Inflation expectations surged, triggering renewed recession fears. As the cost of living continues to squeeze American households, concerns are mounting over how the Federal Reserve will respond to economic headwinds.

The benchmark 10-year Treasury yield (^TNX) dropped to 4.3%, its lowest level this year, as investors increasingly bet that an economic slowdown will prompt interest rate cuts in the coming months.

Crypto Chaos: Bitcoin and Ethereum Take a Beating

The most dramatic movement, however, unfolded in the cryptocurrency market. Bitcoin (BTC-USD) crashed below the $90,000 mark for the first time since November, briefly touching a low of $86,000. Ethereum (ETH-USD), the second-largest cryptocurrency, plunged over 10% to trade below $2,400. The sell-off hammered crypto-related stocks such as Coinbase (COIN) and MicroStrategy (MSTR), both of which saw sharp declines.

Tech in the Crosshairs: Nvidia Under Pressure

The tech sector found itself in the spotlight once again as Nvidia (NVDA), the AI chip powerhouse, braced for its highly anticipated earnings report on Wednesday. Already grappling with tariff headwinds and export controls, the company’s stock faced mounting pressure amid concerns that Trump’s proposed policies could hinder growth in the sector.

Silver Lining: Home Depot Defies Expectations

In a rare bright spot, Home Depot (HD) managed to beat Wall Street’s subdued expectations for its fourth-quarter revenue, offering a sliver of optimism in an otherwise turbulent market.

Final Thoughts: Is More Volatility Ahead?

With political uncertainty, trade tensions, and inflation anxieties dominating headlines, investors are left wondering what’s next. Will Trump’s tariff agenda push the economy toward another slowdown? Can the Fed ease concerns with rate cuts? And how will the crypto market recover from its latest plunge?

For now, all eyes remain on Washington, Wall Street, and the global economy as markets brace for more potential turbulence in the weeks ahead.

Know more about Bitcoin https://theglobalcryptopedia.com/post-3/

RELATED POSTS

View all